Why Did Investors Start Using Ticker Symbols? Efficiency!

You started seeing ticker symbols because they make stock trading more efficient. In the chaos of verbal trading, investors faced miscommunications, like mixing up “AAPL” with “APPL,” causing delays and errors.

The introduction of ticker tape technology in 1867 by Edward Calahan changed the game. It used telegraphic tech to print stock prices on ticker tape, speeding up trades and making information more accessible.

Ticker symbols became a universal shorthand, reducing mistakes and streamlining global market navigation. They’re now key in digital trading and algorithm-driven strategies, enhancing your trading experience. Uncover how these symbols transformed investing next.

Key Takeaways

The Early Stock Market

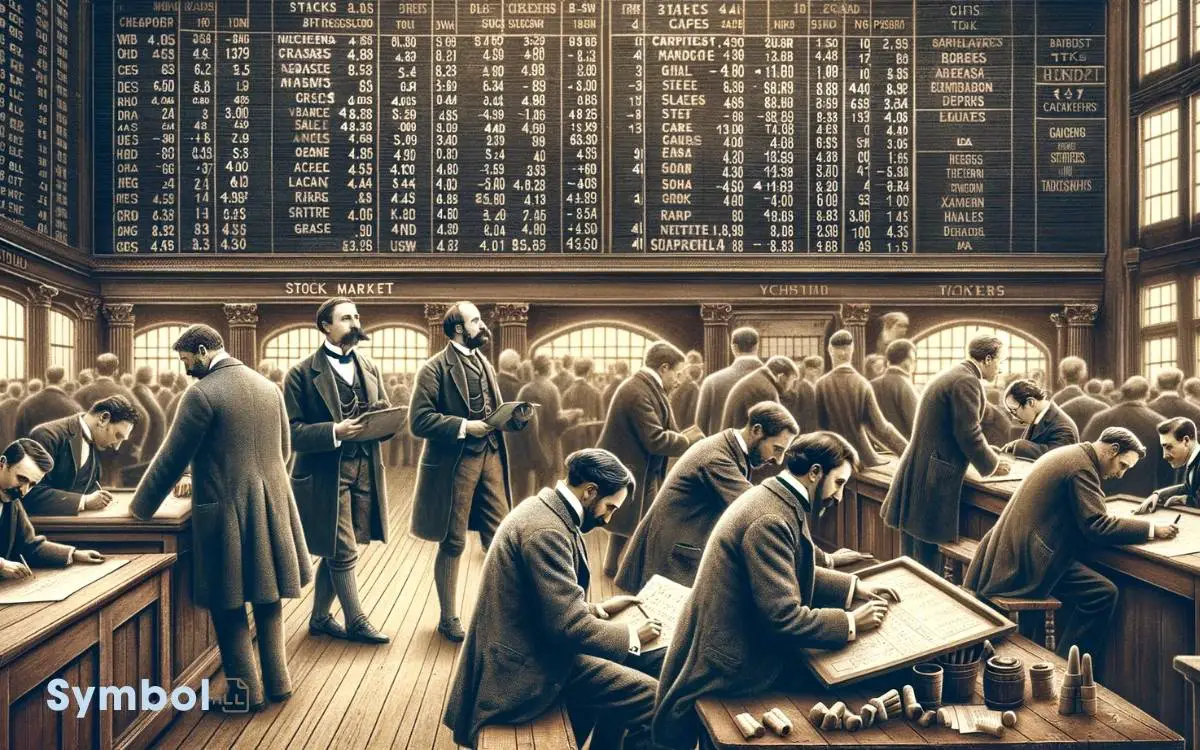

The early stock market, emerging in the 17th century, laid the foundational framework for today’s complex trading systems. You’re delving into an era when trading was a burgeoning concept, yet it intricately wove the fabric of modern finance.

This period was marked by the establishment of the first stock exchange in Amsterdam, a pivotal moment that revolutionized how businesses were funded and ownership was distributed.

As you explore this historical landscape, you’ll find that the introduction of publicly traded companies fostered a new level of economic expansion, setting the stage for the development of sophisticated investment strategies.

It’s crucial to understand that these pioneering steps weren’t merely historical footnotes but were instrumental in shaping the investment world you navigate today.

Challenges of Verbal Trading

You’ve likely noticed that verbal trading introduces significant challenges. Miscommunication risks rise, leading to potential trade execution errors that can cost you dearly.

Additionally, the process consumes more time, slowing down your ability to act swiftly in a fast-paced market.

Miscommunication Risks Increase

In verbal trading, miscommunication risks soar due to the nuanced pronunciation and comprehension of ticker symbols.

This dynamic often leads to costly errors, where a slight misinterpretation can result in the execution of unintended trades. It’s crucial you grasp the gravity of these risks to navigate the trading floor effectively.

| Ticker Symbol | Common Misinterpretation |

|---|---|

| AAPL | APPL |

| BRK.B | BRKB |

| MSFT | MSTF |

| TSLA | TESLA |

| GOOGL |

This table illustrates how easily ticker symbols can be misheard or misspoken, emphasizing the need for heightened precision in verbal exchanges.

As a savvy investor, understanding this layer of complexity helps in mitigating potential miscommunication, ensuring your trading decisions are executed as intended.

Time Consumption Issues

Understanding the risks associated with miscommunication of ticker symbols also brings to light another challenge: time consumption issues inherent in verbal trading.

n the era before ticker symbols became the norm, trading floors were arenas of verbal chaos. This method wasn’t only prone to errors but significantly time-consuming.

Here’s why:

- Lengthy Discussions: Every transaction required a full company name and details, leading to lengthy and repetitive conversations.

- Confirmation Delays: Verifying each trade’s specifics verbally meant more time spent on each transaction, delaying others.

- Increased Queue Time: With traders waiting longer to execute orders, the queue for trades lengthened, slowing down the market’s overall pace.

In essence, the absence of a concise, standardized identification system like ticker symbols markedly slowed the trading process, highlighting the efficiency and necessity of their adoption.

Trade Execution Errors

Trade execution errors were a significant challenge in verbal trading, often leading to costly mistakes and investor dissatisfaction. When you relied on spoken orders, miscommunication was rampant.

The complexity of financial terminology, combined with background noise and poor line connections, heightened the risk of errors.

Misheard or misinterpreted instructions could result in buying the wrong stock, incorrect quantities, or at undesired prices. These mistakes weren’t just minor inconveniences; they often led to substantial financial losses and eroded trust between investors and brokers.

The necessity for a more reliable and precise system became apparent. Ticker symbols emerged as a solution, offering a standardized, error-minimizing method for identifying and trading stocks.

They significantly reduced the chance of trade execution errors, streamlining the process and enhancing overall market efficiency.

Introduction of the Ticker Tape

You’ve seen the challenges of verbal trading, now let’s turn our attention to the introduction of the ticker tape.

This innovation marked a pivotal shift, enhancing trading speed and efficiency by providing real-time stock information.

Understanding its origins and impact reveals how it revolutionized the way investors interact with the market.

Ticker Tape Origins

The ticker tape, a crucial innovation in financial markets, was introduced in 1867 to provide real-time stock transaction information to investors. This development marked a significant leap forward in how financial data was communicated, transforming the landscape of investing.

- Invention by Edward Calahan: Calahan, an employee of the American Telegraph Company, designed the first ticker tape machine, revolutionizing the way stock prices were reported.

- Telegraphic Technology: The system utilized telegraphic technology to print stock prices on a thin paper strip, known as the ticker tape, because of the ticking sound it made.

- Accessibility: This innovation made stock market data more accessible to investors, allowing them to make informed decisions based on the latest information.

Understanding the origins of the ticker tape sheds light on its foundational role in modern financial markets.

Impact on Trading Speed

With the introduction of the ticker tape, investors could now react more swiftly to market changes, significantly accelerating the speed of trading. This innovation didn’t just enhance the pace; it revolutionized how you perceive and engage with the market.

Suddenly, you weren’t waiting for the next day’s paper or a courier to bring you updates. Information flowed in real-time, reducing the lag between an event and your response to it. This immediacy compressed decision-making times, pushing you to develop faster analytical skills.

Moreover, it democratized information, leveling the playing field between the larger institutions and individual investors.

The ticker tape didn’t merely speed up transactions; it transformed the market into a more dynamic, accessible, and fair environment, compelling everyone to adapt to this faster pace or risk being left behind.

Efficiency in Communication

Many investors find that utilizing ticker symbols significantly streamlines communication, making it more efficient and precise. This efficiency isn’t just a matter of speed; it’s about clarity and reliability in the fast-paced world of trading.

Here’s why:

- Universality: Ticker symbols provide a universal shorthand that transcends language barriers, ensuring that all market participants, regardless of their geographic location, speak the same financial language.

- Error Reduction: By condensing company names into a few letters, the likelihood of miscommunication is greatly reduced. This precision is crucial when executing trades.

- Instant Recognition: Seasoned traders can identify and react to opportunities swiftly, as they recognize company symbols instantly, without needing to process longer company names.

This concise method of communication has become indispensable in the trading world, fostering a more interconnected and efficient global market.

The Rise of Electronic Trading

Over recent decades, electronic trading has revolutionized how investors engage with financial markets, making transactions faster and more accessible than ever before.

This shift has drastically altered the landscape of investing. You’re no longer bound by the physical constraints of stock exchanges or the need for direct broker interactions.

Instead, you can execute trades virtually, from anywhere, at any time. This immediacy and accessibility haven’t only increased market participation but also heightened the competition among investors.

With real-time data at your fingertips, you’re equipped to make more informed decisions swiftly.

However, this convenience comes with its challenges, including the need for heightened security measures and a deeper understanding of market dynamics. Electronic trading has undeniably set a new pace for the financial world, emphasizing efficiency and connectivity.

Standardizing Market Language

Standardizing market language, including the use of ticker symbols, streamlines communication and enhances efficiency in the fast-paced world of investing.

By creating a uniform system, you’re not just trading stocks; you’re navigating a global marketplace with precision and clarity.

Consider the benefits of this standardization:

- Simplification: It condenses complex company names into digestible, unique identifiers.

- Error Reduction: Miscommunication is minimized, making transactions more accurate.

- Speed: Information is transmitted swiftly, allowing you to make informed decisions rapidly.

This linguistic framework isn’t just about convenience; it’s a critical infrastructure that supports the integrity and functionality of financial markets.

As an investor, understanding and utilizing this language is paramount in leveraging opportunities and mitigating risks in your investment journey.

Global Trading Needs

Understanding and utilizing standardized market language prepares you for the complexities of global trading. As markets expand beyond borders, the need for a unified system becomes evident.

Ticker symbols serve this purpose, allowing you to engage with international markets effectively. They provide a shorthand that transcends language barriers, making it easier to identify, track, and research assets globally.

This standardization is crucial for maintaining the fluidity of information exchange across different countries and trading platforms. It ensures that you’re equipped to participate in a wider financial landscape, where decisions need to be made quickly and with confidence.

Embracing this system enhances your ability to operate in the global marketplace, where understanding the nuances of international trading can be the key to success.

Reducing Errors in Transactions

Ticker symbols significantly reduce errors in financial transactions by providing a clear and universal identifier for securities across global markets.

By using these unique codes, you’re less likely to confuse one investment for another, ensuring your trades align with your intentions.

Consider how:

- Clarity: Symbols eliminate ambiguity in security names, which might be similar or vary slightly across countries.

- Consistency: They provide a standardized format, making it easier for you to track and manage your investments globally.

- Error Reduction: Automated systems can quickly and accurately process symbols, minimizing manual entry errors.

This approach streamlines transactions, making it simpler for you to execute trades accurately. With ticker symbols, the risk of miscommunication or misinterpretation in orders is drastically lowered, enhancing the efficiency and reliability of financial exchanges.

Speed in Financial Reporting

In today’s fast-paced financial markets, the use of ticker symbols significantly accelerates the speed of reporting and analysis, allowing you to make more informed decisions swiftly.

This streamlined system cuts through the clutter of verbose company names, enabling quicker data retrieval and dissemination.

With these symbols, you’re not just saving time; you’re also accessing a global language of finance that crosses borders effortlessly. This efficiency is crucial during volatile market conditions where seconds can mean the difference between profit and loss.

Adaptation to Digital Platforms

The digital era has revolutionized how investors interact with ticker symbols, seamlessly integrating them into online trading platforms and financial analysis tools.

This adaptation to digital platforms has made it easier for you to:

- Access real-time data on stocks and securities, allowing for informed decision-making.

- Automate trading strategies based on specific ticker symbols, improving efficiency and potentially enhancing returns.

- Customize watchlists and alerts, keeping you informed about movements in stocks of interest without the need for constant manual monitoring.

These digital conveniences have transformed the landscape of investing, making it more accessible and responsive.

You’re now equipped with tools that provide instantaneous updates and analytics, ensuring that the use of ticker symbols is more relevant and powerful than ever in the fast-paced world of finance.

Ticker Symbols Today

You’ve observed the evolution of ticker symbols and their critical role in modern trading. These concise identifiers not only streamline transactions but also embody the history and strategy of their companies.

Understanding them is now fundamental to navigating the complexities of today’s financial markets.

Evolution of Ticker Symbols

Over time, ticker symbols have evolved to become more intuitive, allowing investors to quickly identify companies and their stock without confusion. This evolution reflects the changing landscape of the financial markets and the growing need for efficiency in trading.

- Standardization: Regulatory bodies have implemented rules to standardize ticker symbols, making them universally recognizable.

- Globalization: With the rise of global markets, ticker symbols now accommodate foreign companies, broadening investment opportunities.

- Innovation: The advent of digital trading platforms has necessitated unique symbols for derivatives and other complex financial instruments.

These developments ensure that you, as an investor, can navigate the stock market more effectively. Ticker symbols today not only symbolize a company’s identity but also facilitate a smoother trading experience by minimizing errors and enhancing clarity.

Significance in Modern Trading

In today’s fast-paced markets, ticker symbols serve as crucial navigational tools, enabling investors to swiftly locate and trade stocks with precision.

These symbols, often a mix of letters and numbers, encapsulate a company’s identity in the trading world, streamlining communication and transactions on global exchanges.

You’ll find that their simplicity belies their importance; they eliminate confusion in an environment where milliseconds can mean the difference between profit and loss.

Ticker symbols have evolved into more than identifiers; they’re integral to the algorithm-driven trading strategies that dominate today’s markets.

Their consistency across digital platforms enhances their utility, ensuring you’re always on the same page, whether you’re reading financial news, executing trades, or analyzing stock performance.

In essence, ticker symbols are the lingua franca of the financial markets, indispensable for the modern investor.

Future of Trading Technologies

Exploring the future of trading technologies reveals that advancements are set to revolutionize how investors interact with markets, enhancing efficiency and accessibility.

You’ll find that these emerging technologies not only streamline transactions but also democratize investing, making it more inclusive.

Key innovations on the horizon include:

- Blockchain and Distributed Ledger Technologies (DLT): Ensuring more secure, transparent, and faster transactions.

- Artificial Intelligence (AI) and Machine Learning (ML): Enabling smarter, data-driven investment decisions and predictive analytics.

- Quantum Computing: Potentially reducing complex calculation times from years to seconds, profoundly impacting algorithmic trading.

These advancements promise to reshape the landscape of trading, offering you unprecedented tools and insights. As these technologies mature, they’ll likely become integral to your investment strategy, presenting both new opportunities and challenges.

Conclusion

In the grand tapestry of the stock market, ticker symbols have become the vibrant threads binding the chaos into coherence. Like stars guiding sailors, these symbols illuminate paths through turbulent financial seas, enabling you to navigate with precision and speed.

As the digital horizon expands, your reliance on these beacons of efficiency and clarity grows. Embrace them, for they aren’t just markers of identity but keystones in the evolving edifice of trading, heralding a future where information flows as swiftly as thought itself.